| ARCHIVE |

Good Banking = Good Governance = Good Management |

“Good Banking = Good Governance = Good Management (Good Risk Management)” is actually a truism and therefore, goes without saying. However, at PDIC I have come to look at this statement with a new perspective. Good management, which has among its requisites, good strategies, good risk management and transparency and controls, is actually consistent with the requisites of good banking and good corporate governance.

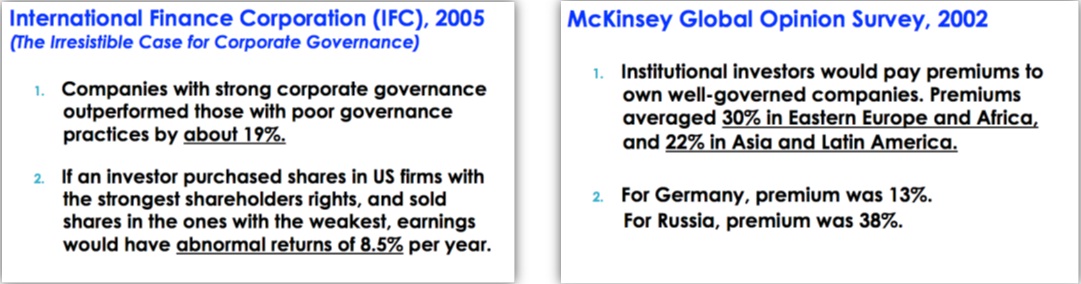

They all relate to the PDIC’s mandates and its 5-year Roadmap. Corporate Governance has been a topical issue over the past 15 years from the Asian financial crisis, the dot.com bubble in 2001-2002 and of course, the Credit crisis triggered by the bankruptcy of Lehman brothers in 2008. The concerns with and thrusts for good corporate governance have beneficial effects. Studies of the International Finance Corporation or IFC and McKinsey Consulting among others show that companies perceived to have good corporate governance are rewarded with premiums on the value of their respective companies shares of stocks over other companies. This means that they have lower costs of capital because of investor appetite for their stocks and bonds.

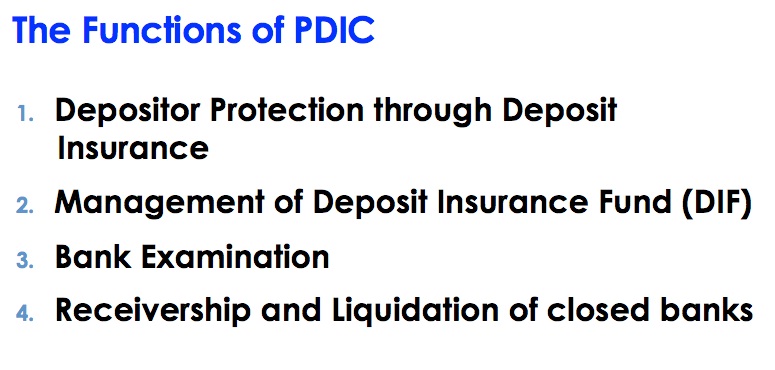

The elements of corporate governance include board independence and effective oversight over management, transparency and risk management. The thrust for corporate governance of member banks is a particular concern for PDIC because of its mandates under the PDIC Charter: deposit insurance and protection, member bank examination, financial stability and the preservation and growth of the deposit insurance fund. Unfortunately when PDIC has to perform its other important function of receivership and liquidation, it usually means that corporate governance in the bank concerned has been deficient.

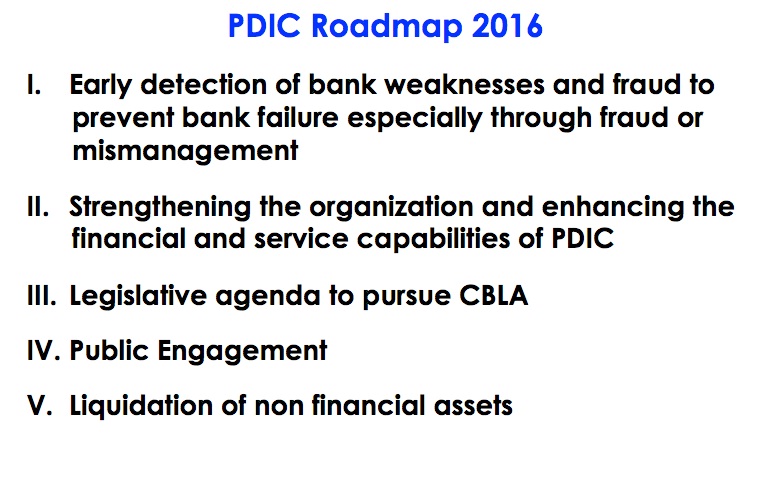

It is quite providential that the current administration has good governance as a lynchpin of its platform of government. In this respect, the PDIC has received solid support from the Department of Finance in this advocacy. The Finance Secretary is the Ex Officio Chairman of the PDIC, which is an attached agency to the Finance Department. The BSP Governor is also an ex officio member of our Board. The Finance Secretary and the BSP Governor can nominate alternate voting members who must be an Undersecretary and a Deputy Governor, respectively. Based on our Charter and the platform of the government, the PDIC Roadmap going forward to 2016 has a strong emphasis in encouraging good governance among member banks. The Roadmap that PDIC has decided to pursue over the next five years has five main and intertwined objectives.

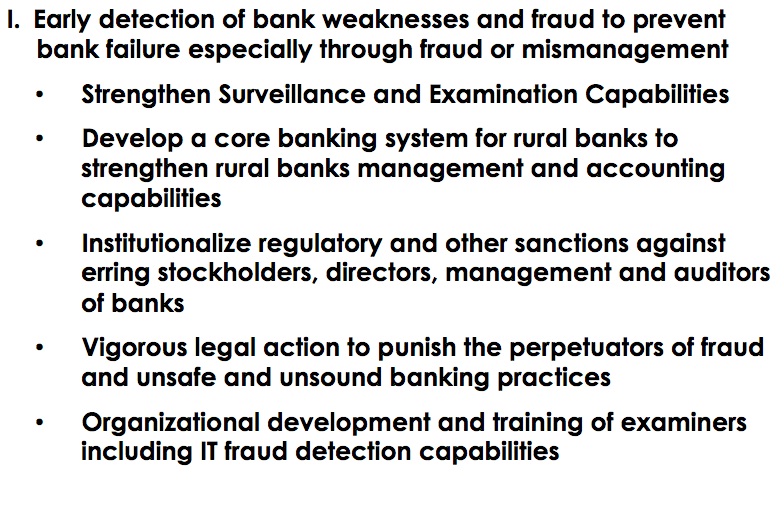

The examination, surveillance and fraud prevention function is the most important. This is because last year alone, 29 banks were closed with a total of 26.4 billion pesos of deposits outstanding accounted for by over 290 thousand bank accounts of which nearly 13 billion pesos were insured. The 26.4 billion of peso deposits is equal to 1.6 percent of the total national budget for last year (2011). Our concern here is not only for the insured deposits but for all the deposits because of the disruption that the closures inflict on our banking system and the destruction it causes on the value and the savings of depositors, as well as the costs to the insurance fund. No less important is the human misery and impoverishment and inconveniences caused to the depositors. You have probably read in the newspapers how the scam perpetrated by the so-called Legacy banks which were closed in 2008 affected deposits totaling 14 billion pesos and how PDIC has already paid out over 11.7 billion pesos. And just to think that the Legacy banks were closed when the deposit insurance coverage was only 250,000 pesos per account. If the deposit insurance coverage had been 500,000 pesos as it is now, the damage would have been much greater. These types of bank frauds cannot be allowed to happen again. And going by the saying that an ounce of prevention is worth a pound of cure, the PDIC is investing in organization, manpower, training and equipment to prevent or nip in the bud, fraudulent and unsafe and unsound activities that endanger bank deposits. And if fraud does occur as it has happened, the PDIC will take all possible actions to bring the perpetrators to justice and recover losses caused by the fraudulent activities. The general public must know that crime does not pay in order for the authorities to effectively protect the banking system and for confidence in the banking system to be sustained.

Strengthening the Organization

Legislative Agenda

Public Engagement has become a very important concern of regulators in recent years prompted by the crisis of 2008. In fact, one of the Core Principles of IADI is public awareness, i.e. “In order for a deposit insurance system to be effective, it is essential that the public be informed on an ongoing basis about the benefits and limitations of the deposit insurance system.” I therefore, thank you again for inviting me to speak before you as this is one way of publicly engaging you as one of our key stakeholders.

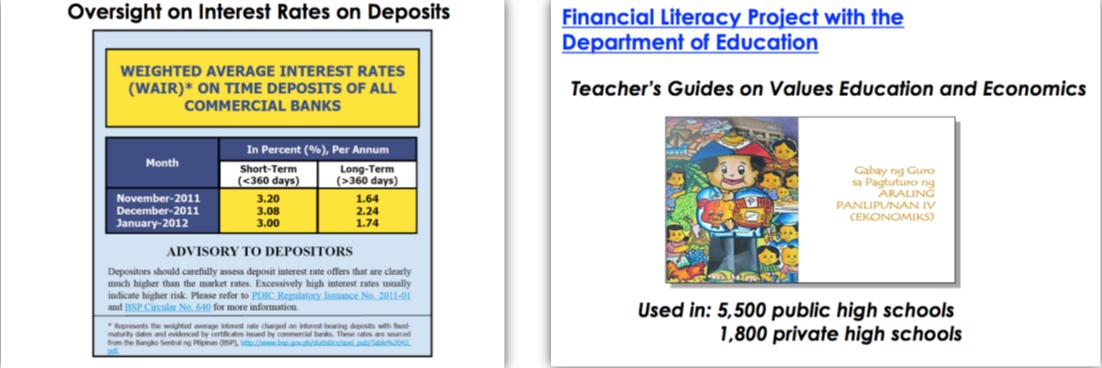

The PDIC website is one medium that is used extensively by PDIC depositors and stakeholders for information and we encourage you to make use of it as well. Interest rates reflect an issue of particular concern. The PDIC website posts advisories on the weighted average interest rates of time deposits offered by commercial banks. BSP Circular BSP Circular 640 and PDIC Regulatory Issuance 2011-01 list as unsafe and unsound banking practice the offering of excessively high interest rates coupled with asset ratios of less than 10% or an operating loss, to fund aggressive growth. We would welcome BAIPHIL and all organizations concerned with financial stability to help us with this in educating the public and please advise us if you are aware of such an unsafe and unsound practice occurring. PDIC Corporate Affairs Group is the unit tasked with carrying out our public engagement programs.

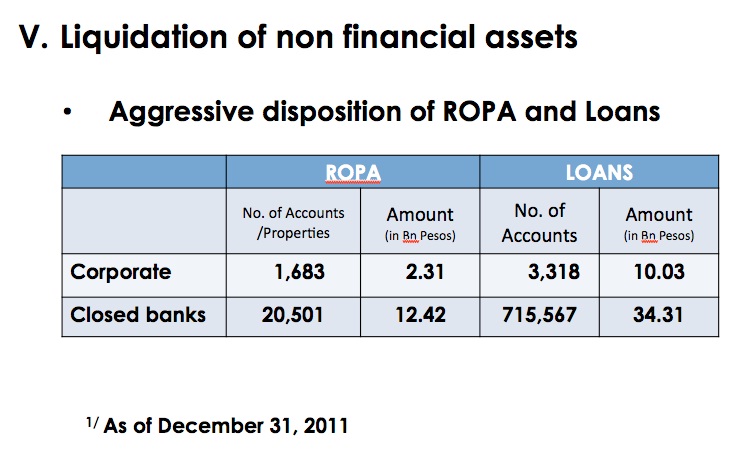

PDIC is particularly proud of its joint financial literacy project with the Department of Education. Its Teacher’s Guides for Values Education and Economics are now being used by 5,500 public schools and 1,800 private high schools. The Liquidation of non-financial assets is a key part of the PDIC roadmap. These assets should be turned into cash and added to the insurance fund in the case of corporate assets or pay off the creditors in the case of closed banks’ assets. No less important are the manpower and resources of the organization that can be freed up to focus its regular mandates. These assets are also very costly to administer and sustain. Information on most of these assets are available through our website.

In closing, we go back to the congruity of Good Banking = Good Governance = Good Management. There should be no conflict as the tenets are all consistent with each other. For PDIC, our roadmap demonstrates that we are also adapting good corporate governance principles internally in order to foster it to the member banks. On behalf of the institution, I express our gratitude to have your monthly meeting as the venue where PDIC first publicly discusses its roadmap for the next 5 years. ____________________________________*Delivered by PDIC President Valentin A. Araneta during the Baiphil General Membership Meeting held on April 24, 2012, Mandarin Oriental Hotel, Makati City. |

back |

This website uses information-gathering tools including cookies and other similar technology. Data generated are not shared with any other party. For more information, please refer to our privacy policy.

PDIC is a government instrumentality created in 1963

PDIC is a government instrumentality created in 1963by virtue of Republic Act 3591, as amended, to insure

the deposits of all banks. PDIC exists to protect

depositors by providing deposit insurance coverage for the depositing public and help promote financial stability. PDIC is an attached agency of the Bangko Sentral ng Pilipinas.

Questions? Need Help?

Click Frequently Asked Questions

Trunkline.: (632) 8841-4000

Hotline: (632) 8841-4141

(for Metro Manila clients)

Fax No.: (632) 8841-4085

Email: pad@pdic.gov.ph

Client outside Metro Manila may call

Toll Free: 1-800-1-888-7342 or

1-800-1-888-PDIC

.png?Monday; April 29, 2024)

Hotline: (632) 8841-4141

(for Metro Manila clients)

Fax No.: (632) 8841-4085

Email: pad@pdic.gov.ph

Client outside Metro Manila may call

Toll Free: 1-800-1-888-7342 or

1-800-1-888-PDIC

.jpeg)

.png)