SINGLE ACCOUNTS / SOLE PROPRIETORSHIP /

"BY" ACCOUNTS / "ITF" ACCOUNTS |

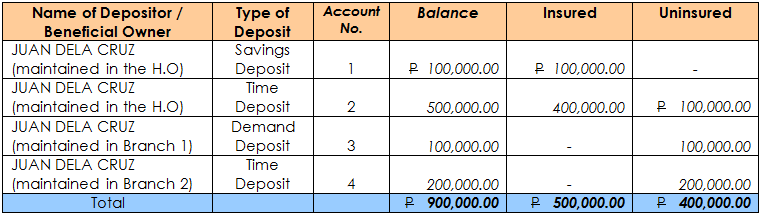

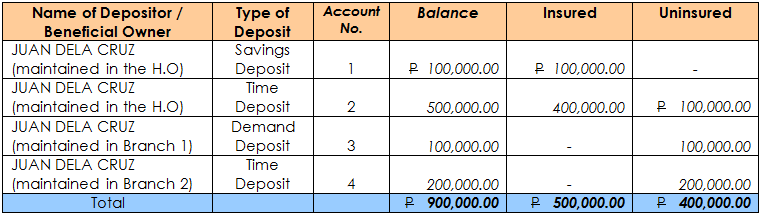

| | Charter Provision: Sec. 4 (g): | | "x x x In determining such amount due to any depositor, there shall be added together all deposits in the bank maintained in the same right and capacity for his benefit either in his own name or in the name of others. x x x" | | Illustrative Cases: | | | Computation of Insured and Uninsured Amount: |  | | Explanations: | -

All the four deposit accounts (i.e., Account Nos. 1 to 4) are owned by the same person, Juan Dela Cruz, and maintained in the same Bank (Head Office and all its Branches), thus, the balance of the accounts will be added together, as they are maintained in the same right and capacity, regardless of account type and banking unit/branch. Total amount of insured deposit cannot exceed P 500,000.00, the Maximum Deposit Insurance Coverage (MDIC).

-

Of the total balance of P 900,000.00, the amount insured is P 500,000.00 and the uninsured amount is P 400,000.00.

| Case 2: Single Account/s and Sole Proprietorship |

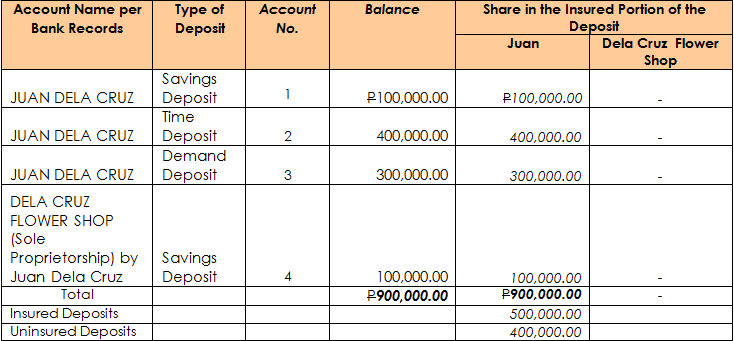

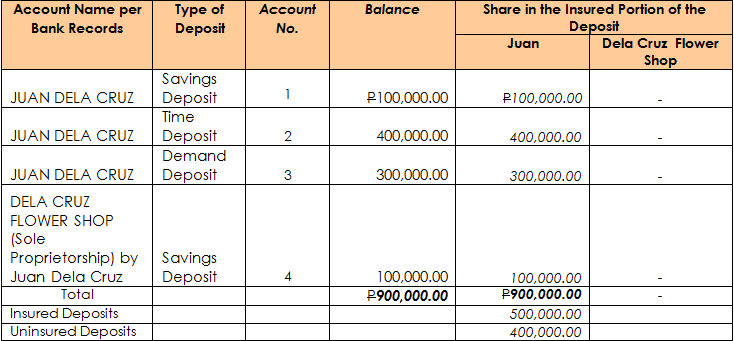

| | Computation of Insured and Uninsured Amount: |  | | Explanations: | -

The first three deposit accounts (i.e., Account Nos. 1 to 3) are owned by the same person, Juan Dela Cruz, hence, the balance of the accounts will be added together.

-

A sole proprietor is wholly owned by the owner, hence, the Dela Cruz Flower Shop (Account No. 4) owned by Juan Dela Cruz will be added to his first three accounts as all of them (Account Nos. 1 to 4) are maintained in the same right and capacity. The total amount insured cannot exceed P500,000.00.

-

Of the total balance of P 900,000.00, the amount insured is P 500,000.00 and the uninsured amount is P 400,000.00.

| Case 3: Single, "ITF" and "By" Accounts |

| | Computation of Insured and Uninsured Amount: |  | | Explanations: | -

Juan Dela Cruz is the principal owner of three accounts (i.e., Account Nos. 1, 3 & 4). As these are maintained in the same right and capacity, these accounts will be consolidated.

The single account (Account No. 1) is under his name alone and the other two are "By" accounts (Account Nos. 3 and 4) which are owned by him as the PRINCIPAL DEPOSITOR or BENEFICIAL OWNER while Maria Dela Cruz and Pedro Dela Cruz ACTED AS HIS AGENTS only. Thus, the total insured amount payable to Juan Dela Cruz is P 500,000.00 and the uninsured amount is P700,000.00.

-

Antonio Dela Cruz on the other hand has only one account (Account No. 2), an "ITF" account in which Antonio is the PRINCIPAL OR BENEFICIAL OWNER and Juan acted as AGENT. Thus, Antonio Dela Cruz is entitled to a separate deposit insurance of P 400,000.00 for his savings deposit.

|

|

PDIC is a government instrumentality created in 1963

PDIC is a government instrumentality created in 1963

.png?Tuesday; April 16, 2024)

.jpeg)

.png)