| ARCHIVE |

‘Tapering’ in the perspective of real economic growth* |

THE term tapering as applied to US economic policy has been understood as the gradual reduction of financial-asset purchases by the central bank of the United States (Federal Reserve) to inject liquidity into the system and to keep interest low. This process was called quantitative easing (QE), which was an extraordinary counterrecessionary measure because of the impact and dangers caused by the credit crisis of 2008 and the European sovereign debt crisis that followed in 2009 to 2012. QE policies, however, has its costs and dangers and now that the US policy-makers are gaining confidence that the US economy is growing at a healthy and sustainable level, QE is expected to be “tapered down.” This development should be perceived as good news for the US and its trading partners. It means more trade and capital flows between the US and the rest of the world. However, the expected end of QE has had an adverse impact on a good number of emerging markets. This is because QE had caused excess liquidity and very low interest rates to seek higher returns outside of the US. As a result, financial-asset prices in emerging-market economies that provided better investment returns were pushed up by portfolio flows. Significant amounts of these funds are now returning to the US and Europe. This indicates that the flows to emerging markets and back now to the US and Europe caused by QE and tapering have been predominantly portfolio flows. However expected, sustained real growth in the US and maybe Europe should lead to greater demand for goods and services from emerging markets—the real economy. The Philippine financial benchmarks, as well as other emerging markets, have adjusted downward due to the tapering concerns. However, the downward adjustments put it in a more competitive position for trade and financial competitiveness going forward. This can be illustrated in the three tables below.

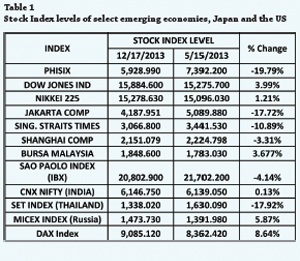

In Table 1, the Phisix has moved down by nearly 20 percent from its peak on May 15 this year to December 17. Other indices that have moved down in similar percentages are Indonesia and Thailand. On the other hand, the US Dow Jones and European DAX indices have gone up by 4 percent and 8.6 percent over the same period.

Table 2 shows that the price-earnings ratio of the Philippine index is still quite high in spite of the significant adjustment from 22.1 to 17.3 times earnings. It is still higher than the December 17 ratio of 15.4 times for the Dow Jones and 15.5 times for the DAX indices.

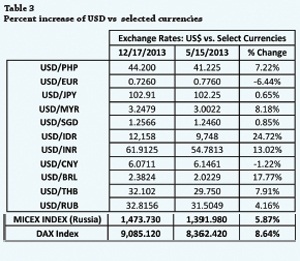

Table 3 shows that tapering in the US also had an impact on exchange rates as funds moved back to the US and Europe. The US dollar appreciated against most currencies in the table, except for the Euro against which the US dollar depreciated by 6.4 percent. However, the US dollar appreciated against the Indonesian rupiah, the Indian rupee and the Brazilian quite substantially over the period and indicated other fundamental economic problems aside from the tapering issue. ____________________________ * Written by PDIC President Valentin A. Araneta for Free Enterprise and published in the Businessmirror on December 25, 2013. Mr. Araneta writes for the Free Enterprise column as a member and officer of the Financial Executives of the Philippines (Finex). Requests for his past articles may be coursed through ccd@pdic.gov.ph. |

back |

This website uses information-gathering tools including cookies and other similar technology. Data generated are not shared with any other party. For more information, please refer to our privacy policy.

PDIC is a government instrumentality created in 1963

PDIC is a government instrumentality created in 1963by virtue of Republic Act 3591, as amended, to insure

the deposits of all banks. PDIC exists to protect

depositors by providing deposit insurance coverage for the depositing public and help promote financial stability. PDIC is an attached agency of the Bangko Sentral ng Pilipinas.

Questions? Need Help?

Click Frequently Asked Questions

Trunkline.: (632) 8841-4000

Hotline: (632) 8841-4141

(for Metro Manila clients)

Fax No.: (632) 8841-4085

Email: pad@pdic.gov.ph

Client outside Metro Manila may call

Toll Free: 1-800-1-888-7342 or

1-800-1-888-PDIC

.png?Wednesday; April 24, 2024)

Hotline: (632) 8841-4141

(for Metro Manila clients)

Fax No.: (632) 8841-4085

Email: pad@pdic.gov.ph

Client outside Metro Manila may call

Toll Free: 1-800-1-888-7342 or

1-800-1-888-PDIC

.jpeg)

.png)